The same rule applies for income from real estate property situated abroad. Nonresidents are subject to withholding taxes on certain types of income.

How Is Foreign Sourced Income Taxed Thannees Articles

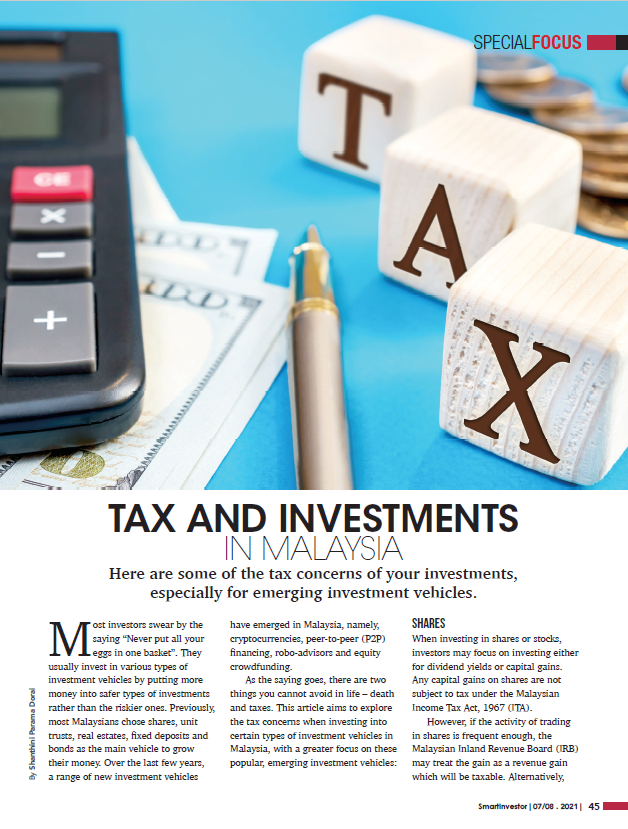

After all many dividend-paying blue-chip stocks are listed on these exchanges.

. Gross income consists of all forms of taxable income eg. The taxable income of the corporation in 2020 should be. Key points of Malaysias income tax for individuals include.

When a stockholder receives a stock dividend which is taxable income. Philippines and sold in Hongkong Compensation received for personal services in the Philippines 200000 Rent income from real property in Malaysia 300000 Gain from sale in the Philippines of shares of a foreign. If a US Company pays a dividend to an Indian Resident shareholder then.

Salary bonuses stock or share-based income foreign-service premiums cost-of-living allowances tax reimbursements and other benefits in kind except for certain tax-exempt items are classified as taxable. Income from employment investment rental real estate. Dividends interest and royalties from Swiss or foreign sources are included in taxable income.

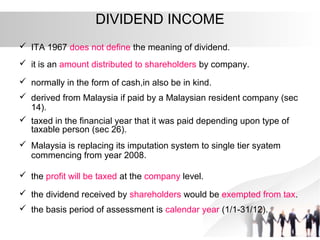

However in certain cantons special methods of assessment may apply for dividend and other income originating outside Switzerland. For example if you take up a job while overseas and you only receive the payment for the job when you are back in Malaysia. Dividend paid by a resident company of a contracting state to a resident of the other contracting state may be taxed in that other state.

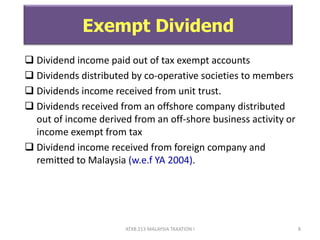

Other income is taxed at a rate of 30. Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is exempted from tax. The best of all is that dividend payouts from these stocks from the Singapore and Hongkong exchanges are not subjected to any tax.

Personal Income tax is payable on the taxable income of residents at the progressive rates from 0 to 30 with effective Year of Assessment 2020. A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer an individual or legal entity by a governmental organization in order to fund government spending and various public expenditures regional local or national and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount. The Singapore and Hongkong stock markets are a haven for retirees.

Dividend And Growth Investing And What Are Dividends Dividend Magic

Pdf Single Tier Tax System Analysis Of Company Dividend Payouts

How Is Foreign Sourced Income Taxed Thannees Articles

Taxation Principles Dividend Interest Rental Royalty And Other So

Dividends My Blog Dividends My Blog

Pdf Single Tier Tax System Analysis Of Company Dividend Payouts

Chapter 5 Non Business Income Students

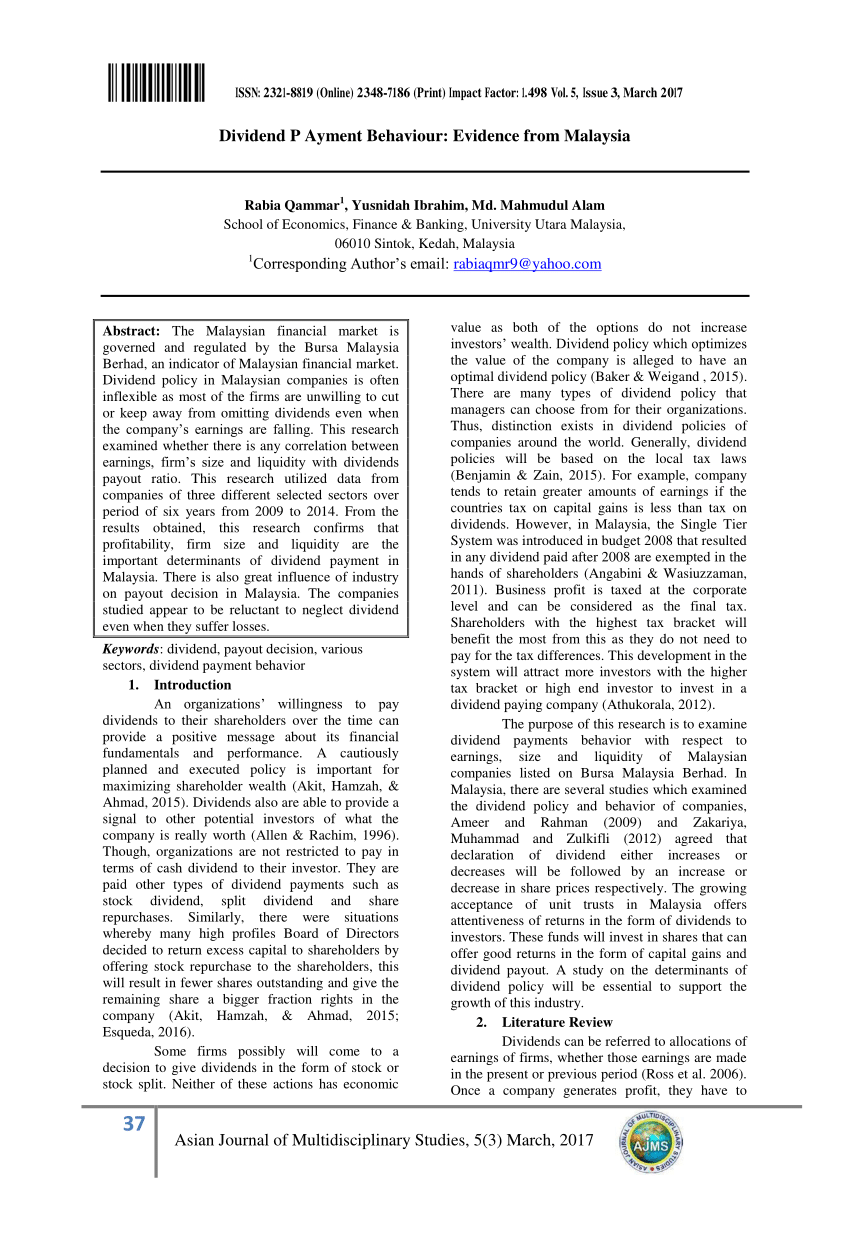

Pdf Dividend Payment Behaviour Evidence From Malaysia

Get Our Sample Of Dividend Payment Voucher Template For Free Dividend Value Investing Payment

Tax And Investments In Malaysia Crowe Malaysia Plt

Malaysian Company Dividends Must The Fruits Of Equity Be Equal Donovan Ho

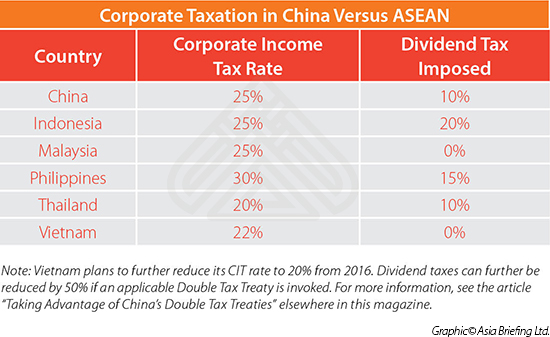

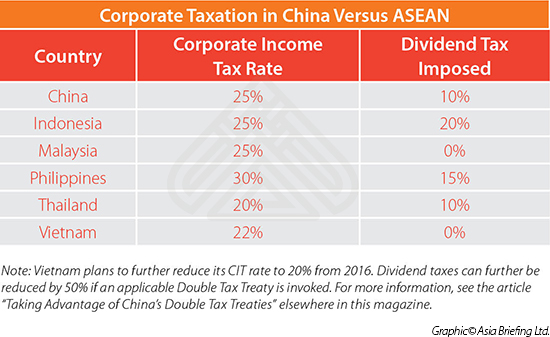

Asiapedia Corporate Taxation In China Versus Asean Dezan Shira Associates

Taxation Principles Dividend Interest Rental Royalty And Other So

Ctim Hails Tax Exemption For Foreign Sourced Dividend Income The Edge Markets

Dividend Tax In Malaysia Tax Lawyers In Malaysia

Economist Calls For New Taxes Next Year Free Malaysia Today Fmt In 2021 Economist Tax Goods And Service Tax

Browse Our Sample Of Dividend Payment Voucher Template Dividend Templates Voucher

Individual Income Tax In Malaysia For Expatriates